Are you tired of feeling uncertain about your financial future? Do you want to take control of your money and ensure a steady cash flow forecast for the next 12 months?

Look no further! In this blog post, we will show you how to create a cash flow forecast using Excel.

With just a few simple steps, you can gain clarity on your income and expenses, allowing you to make informed decisions and plan for a successful financial year ahead. So grab your laptop and let’s dive into the world of cash flow forecasting.

Step 1: Determine your monthly income

When it comes to creating a cash flow forecast, the first step is to determine your monthly income. This is an essential piece of information that will help you understand how much money you have coming in each month.

To begin, gather all sources of income such as your salary, freelance work, rental property earnings, or any other form of consistent revenue. It’s important to include all streams of income for an accurate portrayal.

Next, calculate the total amount earned from each source on a monthly basis. If you receive a fixed salary, this step may be straightforward. However, if your income fluctuates due to variable factors like commissions or bonuses, consider averaging out these amounts over several months for a more realistic estimate.

Remember to exclude any irregular or one-time payments from this calculation since they don’t contribute to regular cash flow and might distort the accuracy of your forecast.

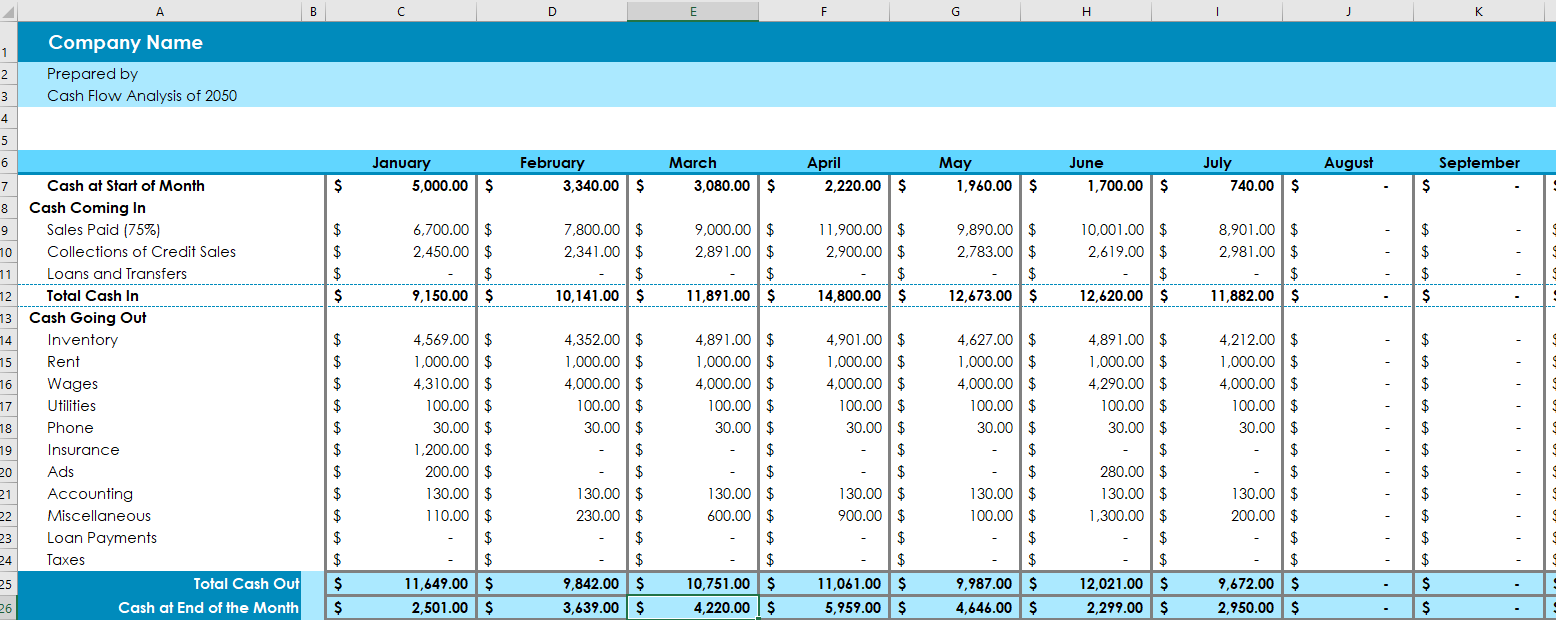

DOWNLOAD CASH FLOW FORECAST TEMPLATE

Cash flow forecast template Click Here

By determining your monthly income accurately and comprehensively in Step 1, you are laying the foundation for better financial planning and forecasting using Excel.

Step 2: Determine your monthly expenses

When it comes to creating a cash flow forecast, knowing your monthly expenses is crucial. This step will help you understand where your money is going and how much you need to allocate for each expense category.

Start by gathering all your financial statements and bills from the past few months. Take note of recurring expenses such as rent or mortgage payments, utility bills, loan repayments, insurance premiums, and subscription services like Netflix or Spotify. Don’t forget about variable expenses like groceries, transportation costs, dining out, entertainment, and personal care items.

Once you have a comprehensive list of your monthly expenses, categorize them into fixed and variable costs. Fixed costs are those that remain constant every month while variable costs may fluctuate depending on different factors.

Next, assign an estimated value to each expense category based on historical data or estimates for future months. Be realistic with these estimations as accuracy is key in creating an accurate cash flow forecast.

Remember to also factor in any upcoming one-time or annual payments such as taxes or holiday gifts. These should be divided by 12 if they are not already included in the monthly expense amount.

By thoroughly determining your monthly expenses in this step, you can better plan for potential gaps between income and expenditures throughout the year. Being aware of where your money goes allows you to make informed decisions about saving opportunities or areas where you can cut back if needed.

Step 3: Subtract your monthly expenses from your monthly income

Now that you have determined your monthly income and identified your monthly expenses, it’s time to take the next step in creating a cash flow forecast using Excel – subtracting your expenses from your income. This step is crucial in understanding how much money you will have left over at the end of each month.

To begin, gather all of your expenses for the month. These can include bills, rent or mortgage payments, groceries, transportation costs, and any other regular expenditures. Be sure to be thorough and include even the smallest expenses.

Next, subtract these monthly expenses from your total income for the month. This will give you an accurate picture of how much money you have remaining after paying all of your bills and meeting financial obligations. It’s important to be realistic with this calculation as it will help guide future financial decisions.

By performing this simple subtraction equation each month and recording the results in Excel, you can start building a comprehensive cash flow forecast that spans 12 months. Not only will this provide insights into where your money is going but also help identify areas where adjustments may need to be made.

Remember that creating a cash flow forecast requires diligence and ongoing monitoring. By regularly updating and reviewing your forecast, you’ll gain valuable insights into managing personal finances effectively.

Step 4: Divide your result by 12 to get your monthly cash flow forecast

Now that you have determined your monthly income and expenses, it’s time to calculate your monthly cash flow forecast. This step is crucial as it will give you a clear picture of how much money you will have left over or if there will be any deficits in the coming months.

To do this, simply take the result from Step 3 (your monthly income minus expenses) and divide it by 12. This will give you an average monthly cash flow projection for the next year.

Dividing the total by 12 allows you to spread out any irregularities or fluctuations in income or expenses over the course of a year. It gives you a more accurate representation of what your finances will look like on a month-to-month basis.

For example, if after subtracting your expenses from your income, you end up with $1,000 per month, dividing that number by 12 would give you an average cash flow forecast of $83 per month.

Remember that this figure is just an estimate based on current data and assumptions. It’s important to regularly review and adjust your cash flow forecast as circumstances change throughout the year.

By following these four simple steps, using Excel as a powerful tool for calculations and projections, creating an accurate and reliable cash flow forecast for the next twelve months becomes achievable for anyone – even those without extensive financial knowledge or experience!

Conclusion

Creating a cash flow forecast for 12 months using Excel can be a valuable tool in managing your finances and planning for the future. By following these simple steps, you can gain insight into your monthly income and expenses, allowing you to make informed decisions about your financial goals.

Remember, the key to an accurate cash flow forecast is regularly updating it with actual income and expense figures. This will help you track any deviations from your initial projections and adjust accordingly.

With Excel’s powerful features and formulas, you have the ability to create a dynamic cash flow forecast that adapts as your financial situation changes. Take advantage of this resource to stay on top of your finances and achieve greater control over your money.

So go ahead, give it a try! Start creating your own cash flow forecast today using Excel. With some practice and diligence, you’ll soon be well-equipped to handle any financial challenges that come your way.

Empower yourself with knowledge by harnessing the power of Excel – take control of your finances like never before!